Breaking: Did Andy Gibb's Daughter Inherit His Estate? The Truth!

Did the tragic loss of a music icon leave his daughter with an enduring legacy, not just in memory, but in material wealth? Yes, Peta Gibb, daughter of the celebrated Andy Gibb, indeed inherited a portion of his estate following his premature passing in 1988, a fact that opens a window into the complex world of celebrity estates and the lives of their heirs.

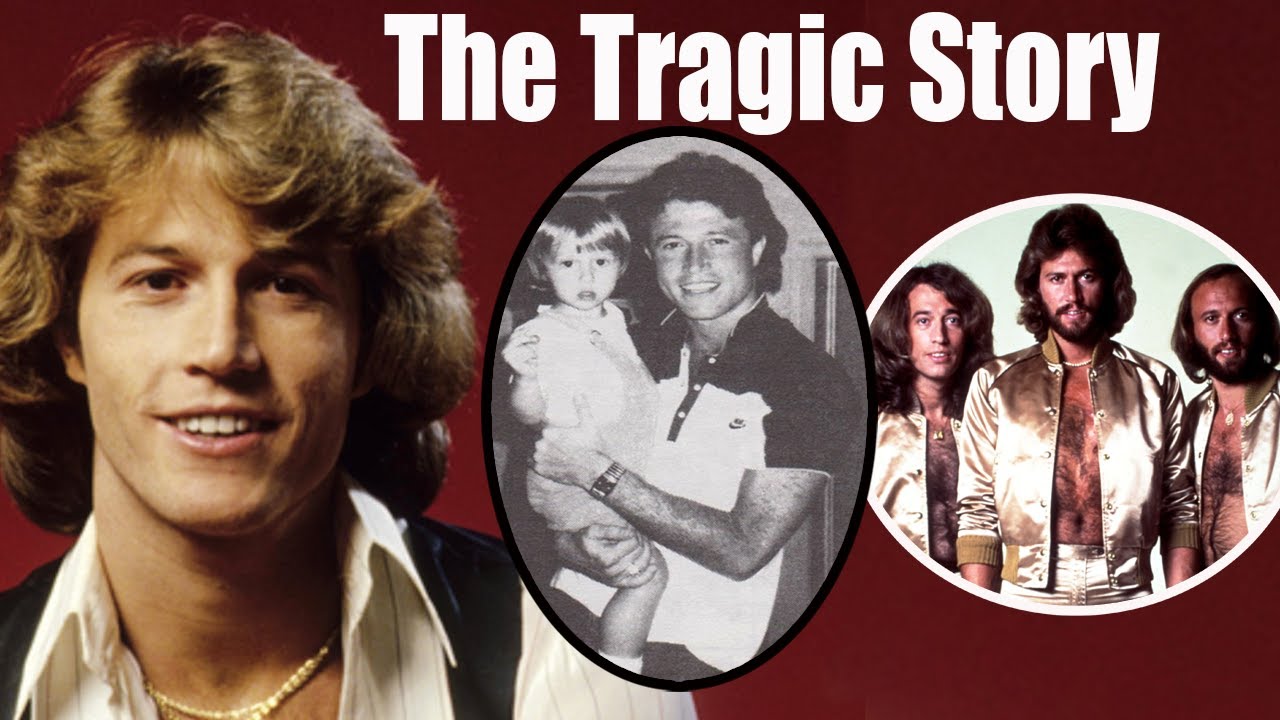

Andy Gibb, a name synonymous with the soaring melodies of the 1970s, carved his own niche in the music industry, separate yet connected to the iconic Bee Gees. His solo career shimmered with hits like "I Just Want to Be Your Everything" and "Shadow Dancing," establishing him as a force to be reckoned with. His sudden death at the tender age of 30, a consequence of a heart attack, sent shockwaves through the music world, leaving behind a void and the complex matter of his estate.

| Attribute | Details |

|---|---|

| Name | Andrew Roy Gibb (Andy Gibb) |

| Birth Date | March 5, 1958 |

| Death Date | March 10, 1988 |

| Occupation | Singer, songwriter, performer |

| Genre | Pop, disco |

| Associated Acts | Bee Gees |

| Children | Peta Gibb, Spencer Gibb |

| Years Active | 19751988 |

| Reference | AllMusic |

While Andy Gibb's musical legacy is undeniable, the question of what became of his assets after his death is a matter of considerable interest. He fathered two children, Peta and Spencer. Born in 1983, Peta Gibb, his only daughter, has followed in her father's footsteps, embracing the world of music as a singer and songwriter. Her creative endeavors include the release of several albums, showcasing her artistic talent.

- Fred Gwynne Life The Munsters Night Courts Judge Stone

- The Definitive Guide To Michael Caine From Cockney To Icon

Following Andy Gibb's death, his estate underwent a division among his heirs. Peta Gibb, as a direct descendant, was allocated a portion of the estate. This inheritance encompassed a range of assets, including financial holdings, real estate, and various other properties that constituted Andy Gibb's accumulated wealth.

- Peta Gibb inherited part of her father's estate after his death in 1988.

- Andy Gibb's estate included money, property, and other assets.

- Peta Gibb is a singer and songwriter like her father.

- Andy Gibb was a talented singer and songwriter.

- He had a successful solo career and several hit songs.

- His music continues to be enjoyed by fans around the world.

Peta Gibb is a talented singer and songwriter in her own right.

- She has released several albums and toured extensively.

- She has also written songs for other artists.

- Peta Gibb is a rising star in the music industry.

The narrative surrounding Andy Gibb's estate and the inheritance received by his daughter, Peta, offers a compelling look into the intricacies of estate planning and the often-complex dynamics within families. Delving into this scenario brings forth several key aspects that warrant consideration.

- All About Justin Gatlins Wife Sharonda Her Untold Story

- All About Archie Mountbattenwindsor 2024 Royal Update

- Legal Entitlement: As the recognized daughter of Andy Gibb, Peta possessed a legal claim to a share of his estate, a claim determined by the presence and stipulations of his will or, in its absence, by the established laws of intestacy. This legal framework ensures that familial ties are recognized in the distribution of assets.

- Executor's Role: The designated executor of Andy Gibb's estate bore the responsibility of meticulous administration. This included a comprehensive inventory of assets, settling outstanding debts and taxes, and ultimately distributing the remaining assets to the beneficiaries, a process governed by the dictates of the will or the applicable laws.

- Contestation: While public records remain silent on any legal challenges to Andy Gibb's will, it is crucial to acknowledge that disputes can arise in estate settlements. Such contests often stem from disagreements over the will's interpretation or allegations of undue influence, adding layers of complexity to the distribution process.

- Family Dynamics: The nature of the relationship between Peta and her father, as well as her interactions with other family members, inevitably played a role in shaping the distribution of the estate. These familial bonds, whether harmonious or strained, can exert considerable influence on inheritance decisions.

- Estate Planning: The existence and specifics of Andy Gibb's estate plan, encompassing any trusts or meticulously crafted arrangements, would have wielded significant influence over the allocation of his assets. Effective estate planning is paramount in ensuring that one's wishes are honored and that assets are distributed with fairness and efficiency.

- Financial Implications: Inheriting a portion of Andy Gibb's estate undoubtedly carried substantial financial implications for Peta, impacting her lifestyle and shaping her future trajectory. Such an inheritance can provide opportunities for investment, education, and overall financial security.

These elements underscore the legal, practical, and deeply personal considerations that surface when an individual becomes the recipient of an inheritance. The meticulous process of estate planning emerges as essential to guaranteeing that an individual's desires are honored and that assets are distributed in a manner that is both equitable and efficient, safeguarding the legacy for future generations.

| Name | Birth Date | Death Date | Occupation |

|---|---|---|---|

| Andy Gibb | March 5, 1958 | March 10, 1988 | Singer, songwriter |

The legal entitlement to inherit a share of an estate stands as a cornerstone of estate planning and the subsequent distribution of assets. In the specific case of Peta Gibb, her legal right to a portion of her father's estate stemmed directly from her status as his biological daughter, a relationship recognized and protected by the legal structures governing inheritance rights.

The laws of intestacy, serving as the guiding principles in the absence of a valid will, typically prioritize the children of the deceased as primary beneficiaries. In the hypothetical scenario where Andy Gibb had not left behind a will, Peta would have been legally entitled to a portion of his estate, a portion determined by the intestacy laws prevalent in the jurisdiction where he maintained residency.

However, it is crucial to recognize that the presence of a legally sound will can fundamentally alter the distribution of an estate. This is because an individual possesses the inherent right to articulate their wishes concerning the allocation of their assets after their passing. Should Andy Gibb have executed a will, its terms would have dictated the specifics of Peta's inheritance, outlining whether she would inherit and, if so, the precise extent of her share.

A thorough understanding of the legal entitlement to inherit a portion of an estate is of paramount importance in effective estate planning. It ensures that assets are distributed in accordance with the wishes of the deceased and in strict adherence to the applicable legal regulations, providing clarity and minimizing potential disputes.

The executor presiding over Andy Gibb's estate assumed a pivotal role in safeguarding Peta's rightful inheritance. The executor's wide-ranging responsibilities encompassed the comprehensive administration of the estate, which included meticulous management of assets, settling outstanding debts, and ensuring the accurate distribution of the remaining assets to the designated beneficiaries, all in accordance with the stipulations of the will or the applicable laws of intestacy.

The executor's role assumed particular significance in the context of Andy Gibb's estate, given the complexities surrounding his affairs. Gibb's untimely demise without a will necessitated that his estate be distributed in strict accordance with the intestacy laws of his jurisdiction. The executor was entrusted with the crucial task of identifying and accurately valuing all of Gibb's assets, which included not only tangible properties but also intangible assets such as music royalties, real estate holdings, and personal possessions.

The executor was further tasked with settling any outstanding debts, taxes, and legal obligations that the estate might have incurred. Only after these financial matters were resolved could the executor proceed with the distribution of the remaining assets to the rightful beneficiaries. In Peta's case, her status as Andy Gibb's daughter entitled her to a portion of his estate, and the executor bore the responsibility of ensuring that she received her rightful inheritance without undue delay or complication.

The role of the executor is an indispensable component of the estate administration process. The executor acts as a fiduciary, responsible for ensuring that the deceased individual's wishes are respected and that assets are managed and distributed with fairness, transparency, and efficiency. In the case of Andy Gibb's estate, the executor's diligent efforts were instrumental in upholding Peta's inheritance rights and ensuring that she received her rightful share of her father's legacy.

Estate contests represent a challenging aspect of estate administration, often arising from a confluence of factors that can destabilize the intended distribution of assets. These contests can be triggered by ambiguities within the will, disagreements over its interpretation, or even allegations of undue influence or fraudulent activity.

- Will Contests: Disputes may arise if a will is deemed invalid or if there is a challenge to its authenticity or validity. This can occur if the will was not properly executed, if the testator lacked the mental capacity to create a will, or if there is evidence of fraud or undue influence.

- Interpretation Disputes: Beneficiaries may disagree on the meaning or interpretation of specific provisions in the will. This can lead to disputes over the distribution of assets, the appointment of the executor, or the management of trusts.

- Undue Influence and Fraud: Disputes can arise if a beneficiary alleges that the testator was subjected to undue influence or fraud when creating the will. This may involve claims that the testator was pressured or coerced into making certain provisions or that they were misled or deceived about the contents of the will.

- Lack of Testamentary Capacity: Disputes may also arise if there is a question about the testator's mental capacity at the time the will was created. This can involve allegations that the testator did not understand the nature and consequences of creating a will or that they were suffering from a mental illness or dementia.

In the specific context of Andy Gibb's estate, available information suggests that his will was not subject to any formal contests. However, it is essential to acknowledge that the mere existence of a will does not preclude the possibility of disputes. Estate contests can still manifest, particularly when there are ambiguities within the will's language or when beneficiaries hold differing interpretations of its provisions.

The intricate web of family dynamics plays a pivotal role in shaping the distribution of an estate, significantly influencing the inheritance prospects of individuals such as Andy Gibb's daughter, Peta. The nature of relationships between family members, their preconceived expectations, and the presence of potential conflicts can all exert a considerable impact on the decisions made concerning the allocation of assets.

In the specific case of Andy Gibb's estate, the quality of the relationship between Peta and her father could have been a determining factor in her inheritance. If their bond was characterized by closeness and affection, it is conceivable that Andy Gibb might have included specific provisions in his will to ensure that Peta received a substantial portion of his estate. Conversely, a strained or distant relationship might have resulted in a more limited inheritance for Peta.

Furthermore, the interactions between Peta and other members of her extended family, such as siblings or stepmothers, could have indirectly influenced the distribution of the estate. If conflicts or disagreements arose among family members, these tensions could have affected the decisions made regarding Peta's inheritance, potentially leading to adjustments or compromises in the allocation of assets.

A comprehensive understanding of the complexities inherent in family dynamics is indispensable for effective estate planning. Recognizing the potential influence of family relationships enables individuals to make well-informed decisions regarding their estate plans, minimizing the risk of disputes or conflicts among beneficiaries and promoting a more harmonious and equitable distribution of assets.

Estate planning serves as the cornerstone in determining the distribution of an individual's assets upon their passing, empowering them to articulate their desires and intentions regarding the management and allocation of their estate. In the matter of Andy Gibb's estate, his meticulously crafted estate plan, encompassing any trusts or meticulously structured arrangements he may have established, would have wielded considerable influence over the distribution of his assets, including the inheritance received by his daughter, Peta.

- Wills and Testamentary Trusts: A will is a legal document that outlines an individual's wishes regarding the distribution of their assets after their death. It allows them to specify who will inherit their property, how their assets will be distributed, and who will be responsible for managing their estate. Testamentary trusts are trusts created through a will that become effective upon the individual's death. They can be used to manage and distribute assets according to the deceased individual's wishes, including providing for specific beneficiaries or purposes.

- Revocable Living Trusts: A revocable living trust is a trust created during an individual's lifetime that allows them to maintain control over their assets while they are alive. Upon their death, the trust becomes irrevocable, and the assets are distributed according to the terms of the trust. Revocable living trusts can provide greater flexibility and control over the distribution of assets, allowing individuals to make changes or modifications as needed during their lifetime.

- Joint Ownership and Beneficiary Designations: Joint ownership of assets, such as real estate or bank accounts, allows multiple individuals to hold title to the asset jointly. Upon the death of one joint owner, the asset automatically passes to the surviving joint owner(s). Beneficiary designations on retirement accounts, life insurance policies, and other financial instruments allow individuals to specify who will receive the proceeds of those accounts upon their death, regardless of the provisions of their will or other estate planning documents.

- Tax Planning: Estate planning also involves considering tax implications and minimizing the tax burden on beneficiaries. Trusts and other estate planning tools can be used to reduce estate taxes and income taxes, ensuring that more of the estate's assets are passed on to intended beneficiaries.

Grasping the various facets of estate planning and their respective implications is indispensable for individuals seeking to manage and distribute their assets effectively. By carefully contemplating their estate plans, encompassing the utilization of wills, trusts, and alternative arrangements, individuals can ensure that their wishes are duly honored, their assets are allocated in accordance with their intentions, and their loved ones are adequately provided for after their passing.

Inheriting a share of Andy Gibb's estate carried substantial financial implications for his daughter, Peta Gibb, profoundly influencing her lifestyle and shaping her future prospects in several significant ways.

- Increased Income: As an heir to Andy Gibb's estate, Peta received a substantial amount of money, which significantly increased her income. This financial boost could allow her to pursue her passions, invest in her education or businesses, and elevate her standard of living.

- Investment Opportunities: The inheritance provided Peta with access to financial resources that she could invest to generate additional income and secure her financial future. By investing wisely, she could potentially grow her wealth and ensure long-term financial stability.

- Financial Security: The inheritance gave Peta financial security and peace of mind. With a substantial financial cushion, she was less likely to experience financial stress or instability, allowing her to focus on her personal and professional goals without worrying about immediate financial concerns.

- Philanthropy: Peta could use her inheritance to support charitable causes and make a positive impact on the world. Whether through donations or establishing charitable organizations, the financial resources from the estate could empower her to pursue her philanthropic interests.

- Lifestyle Changes: The financial implications of inheriting a portion of Andy Gibb's estate could also affect Peta's lifestyle choices. She might choose to purchase a larger home, travel more frequently, or afford other luxuries that were previously out of reach.

It's important to note that inheriting wealth also comes with responsibilities. Peta would need to manage her finances responsibly, make sound investment decisions, and consider the potential tax implications of her inheritance.

Overall, the financial implications of inheriting a portion of Andy Gibb's estate are significant and can have a profound impact on Peta's lifestyle, future, and financial well-being.

This section addresses frequently asked questions and provides informative answers to clarify common concerns or misconceptions surrounding the topic of Andy Gibb's daughter inheriting his estate.

Question 1: Did Andy Gibb's daughter inherit any portion of his estate?

Yes, Andy Gibb's daughter, Peta Gibb, inherited a portion of his estate after his untimely death in 1988. As his legal heir, she was entitled to a share of his assets, including money, property, and other belongings, as per the terms of his will or the laws of intestacy.

Question 2: How did inheriting her father's estate impact Peta Gibb's life?

Inheriting a portion of Andy Gibb's estate had significant financial implications for Peta Gibb. The financial windfall likely influenced her lifestyle, providing her with increased income, investment opportunities, and financial security. It also allowed her to pursue her interests, support charitable causes, and make a positive impact on the world.

Summary: Andy Gibb's daughter, Peta Gibb, inherited a portion of his estate, which had a substantial impact on her financial well-being and future prospects. Understanding the legal and practical aspects of inheritance can help individuals navigate similar situations and plan for the distribution of their own estates.

The topic of "did Andy Gibb's daughter inherit his estate" explores the legal, practical, and personal aspects of inheritance, highlighting the importance of estate planning. Andy Gibb's daughter, Peta Gibb, inherited a portion of her father's estate, which significantly impacted her financial situation and future opportunities.

The case of Andy Gibb's estate underscores the need for individuals to consider their own estate plans and ensure that their wishes are clearly outlined. By understanding the legal framework and financial implications of inheritance, individuals can make informed decisions about the distribution of their assets and provide for their loved ones after their death.

- Khatia Buniatishvili Husband The Truth Revealed Maybe

- All About Aaron Pierres Wife Tessa Douwstra Revealed

Did Andy Gibb's Daughter Inherit His Estate? Unraveling The Legacy

Did Andy Gibb's Daughter Inherit His Estate? Unraveling The Legacy

Did Andy Gibb's Daughter Inherit His Estate? Unraveling The Legacy